050 wef 01062018 EDLIS Charges. The Employees Provident Fund Organisation EPFO is estimated to have invested at least 10000 crore in top-rated public-sector company bonds including that of Indian Oil Hindustan Petroleum and National Bank for Agriculture and Rural Development NABARD some of which have offered rates up to 9 basis points less than.

Pathogens Free Full Text Update On Streptococcus Suis Research And Prevention In The Era Of Antimicrobial Restriction 4th International Workshop On S Suis Html

EPF contribution into an employees EPF account is made every month in equal proportion both by the employer and the employee.

. AC 2 AC 10 AC 21 and AC 22. Employees Provident Fund Schemes. More contribution of Rs1920 but less take home from now onward.

EMPLOYEES PROVIDENT FUND ACT 1991. The review of the EPF interest rate for a financial year is set at the end of that financial year most probably in February but may go up to April or May. Presently the following three schemes are in operation.

But from now onwards it includes BasicDAAllowances. Latest update 25-July-2017. Board of Trustees to be body corporate.

All PF subscribers can now use this new facility to submit their online EPF transfer requests. How to do Online EPF transfer through Unified portal. Akta A1300 BE IT ENACTED by the Duli Yang Maha Mulia Seri Paduka Baginda Yang di-Pertuan Agong with the.

An Act to provide for the law relating to a scheme of savings for employees retirement and the management of the savings for the retirement purposes and for matters incidental thereto. PF Contribution Rate 2021 Account Wise. 01042017 The employer is required to pay his contribution and deduct employees contribution from wages and deposit the same with ESIC within 15 days from the last day of the calendar month in which the contribution fall due.

Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. The Employees Provident Fund Organization EPFO Central Board of Trustees after consultation with the Ministry of Finance reviews the EPF interest rates every year. Most of the time the name and date of birth details in the EPF account are incorrect ie.

This is more of a kind of forced savings scheme issued by the Government of India which helps employees amass a retirement corpus. But indirectly you are investing higher. Acts and proceedings of the Central Board or its Executive Committee or the State Board not to be invalidated on certain grounds.

Contribution to EPF will be 12 of Rs46000 which is Rs5520. The amount returned to the employee will be based on Table D- EPS Scheme 1995. Kindly go through this article for more details.

The EPF interest rate is reviewed every year by the EPFO Central Board of Trustees after consultation with the Ministry of Finance. B Member can defer the pension up to 60 years with contribution s. From above example you may see a cut in your take home pay.

The review of the EPF interest rate for a financial year is set at the end of the financial year. For the financial year 2021 the Employee Provident Fund interest rate is set at 850. The EPFO has recently replaced OTCP facility with a new interface on Unified Members portal.

Every challan consists a unique TRRN number which will help you to track the challan details. So your total salary from above example will be Rs46000. EPF challan consists of total wages of employees and account numbers like AC 1.

The lump sum withdrawal from EPS is allowed if the person has served less than 10 years. EPF Admin Charges. A Member can deter the pension up to 60 years without contribution Member may defer the pension up to 59 years or 60 years of age without contributionBenefit of increase in original peosion amount of 4 in case of one completed year and 816 in case of 2 completed years.

EPF challan is required to make the PF contributions payments of the employee and employer. EPFO goes long on top PSU bonds. A few days before the official announcement of these EPF dividend rates there are some posting and sharing on the internet that EPF members can expect a very good dividend rate for 2017.

A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952. The EPF interest rate for FY2020-21 was 850 unchanged from FY2019-20. On 10 February 2018 EPF announces that the EPF dividend for 2017 is 69 konvensional saving and 64 shariah savings.

EPF Contribution by Employee. The amount will be based on the last drawn wages multiplied by the number mentioned in.

What Is The Epf Contribution Rate Table Wisdom Jobs India

Chongguo Tian Professor Phd Chinese Academy Of Sciences Beijing Cas Yantai Institute Of Coastal Zone Research

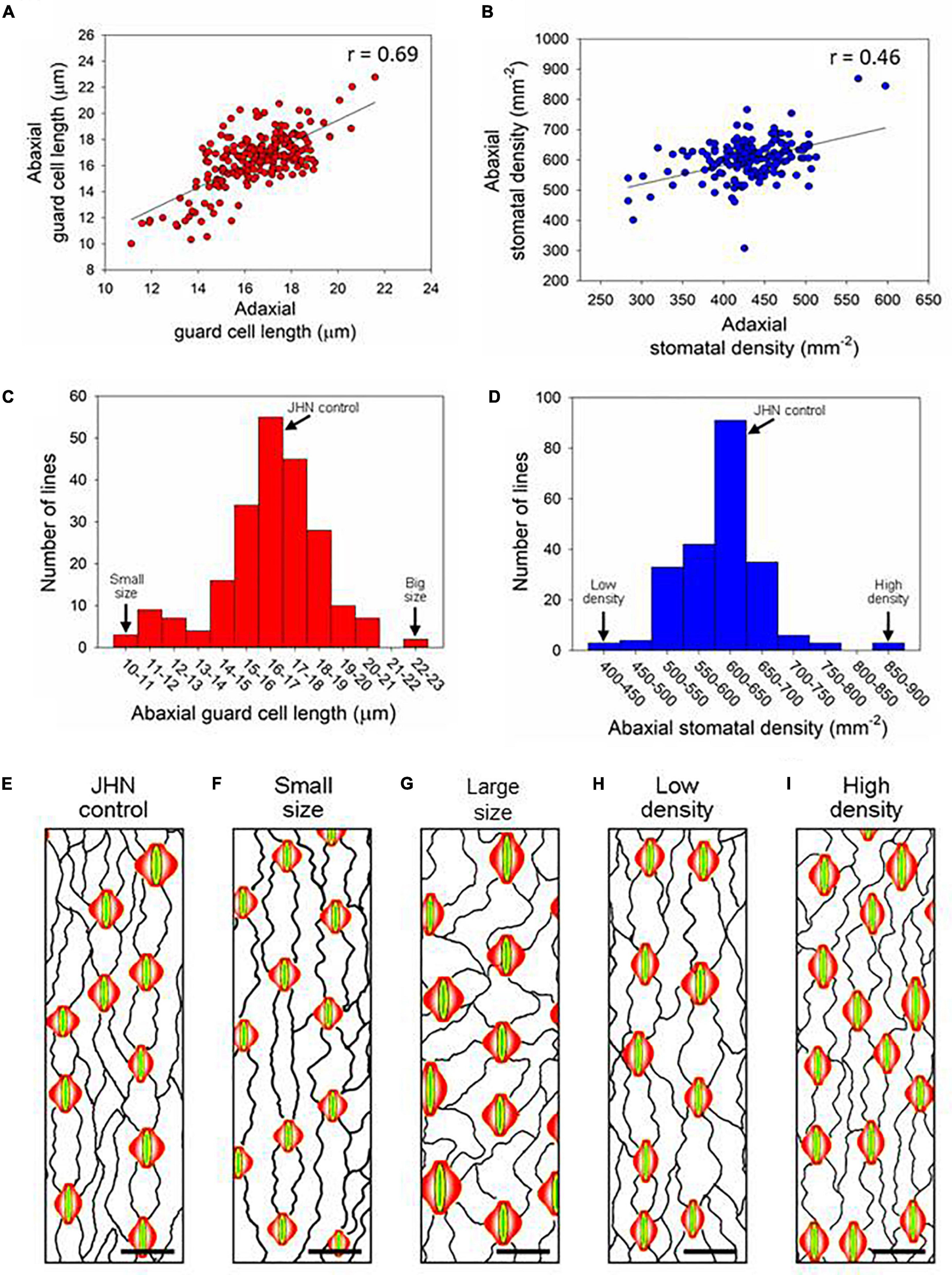

Frontiers Induced Genetic Variations In Stomatal Density And Size Of Rice Strongly Affects Water Use Efficiency And Responses To Drought Stresses Plant Science

Pdf Methods For Cell Volume Measurement

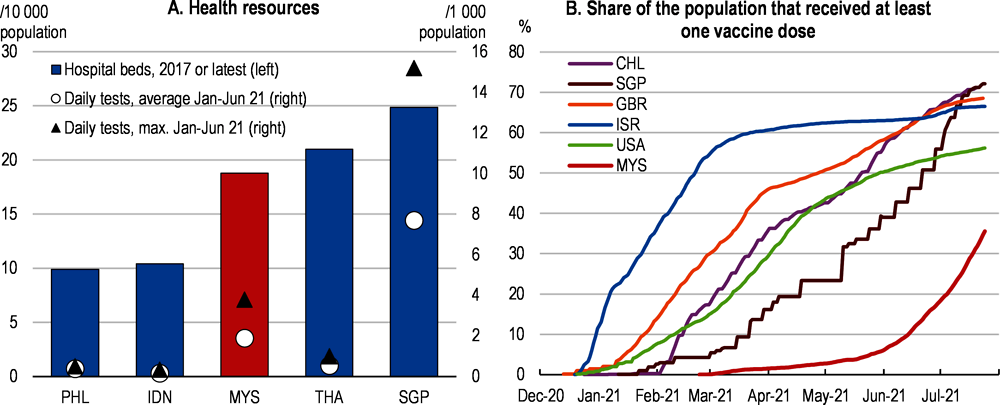

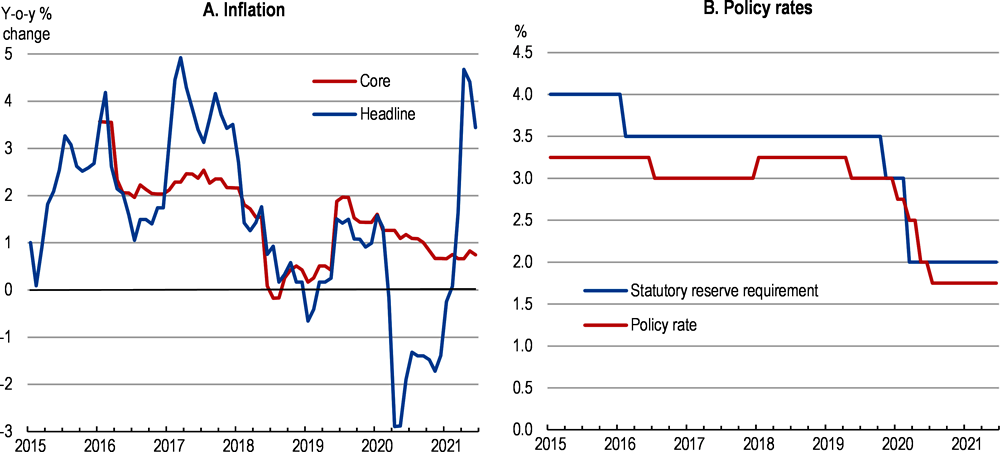

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

An Example For Lemma 1 Download Scientific Diagram

Tweets With Replies By Clark Gray Clarklgray Twitter

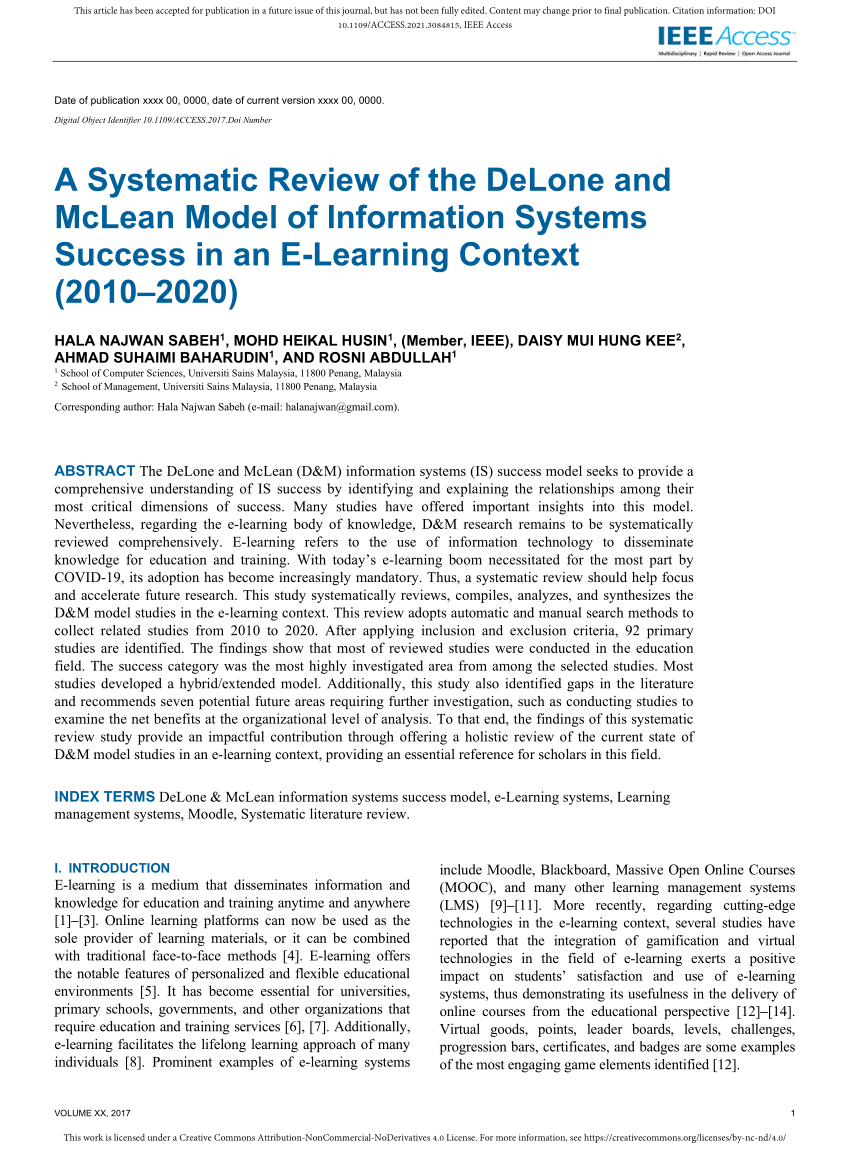

Pdf A Systematic Review Of The Delone And Mclean Model Of Information Systems Success In An E Learning Context 2010 2020

Malaysia Labour Force Urban Selangor Economic Indicators Ceic

Epf Interest Rate In Hindi Sep 2020 Calculator 2017 18 Pf Calculation Excel Online

Vegetation Changes In Temperate Ombrotrophic Peatlands Over A 35 Year Period Abstract Europe Pmc

Life Expectancy And Mortality Rates In Malaysia Download Table

Vegetation Changes In Temperate Ombrotrophic Peatlands Over A 35 Year Period Abstract Europe Pmc

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

30 Nov 2020 Bar Chart Chart 10 Things

8 Mac 2021 Commercial Marketing D I D